PropNex Picks

|December 10,2024Going Over the Hedge and Beating Inflation

Share this article:

If you've been to the grocery store lately, filled up your car, or even scrolled through your favorite online shop, you've probably noticed something: things are getting more expensive. That sneaky little thing we call inflation is making your money feel a little lighter these days. It's not your imagination-prices have been creeping up, and it's starting to affect everything from your daily kopi order to big-ticket purchases.

But don't panic! There are ways to protect yourself from the inflation beast. In this post, we're going to dive into some practical strategies to help keep your hard-earned cash from losing its value and maybe even put your money to work for you during these unpredictable times. Ready to fight back? Let's go!

Well, firstly we need to understand what exactly inflation is before diving into its effects. Imagine you go to your favourite wanton noodle stall and realise that prices are up $0.50, but you still buy it anyway and go back to your table to gossip with your kakis saying how inflation is making things expensive. Yes and no, it might or might not be inflation. If the wanton noodle stall was recently awarded the MICHELIN's Bib Gourmand, then raising its price might just be due to rising popularity and accreditation would not be considered as inflation.

Inflation would have to be prices of goods and services rising across the board. Inflation rates are used to tell us how much and how quickly the levels of the prices are changing. Rising prices are not naturally a bad thing, if it is moving low and stable, it signals a healthy and robust economy. It only starts becoming a problem when the inflation rates are rising too quickly, it means that we have less purchasing power.

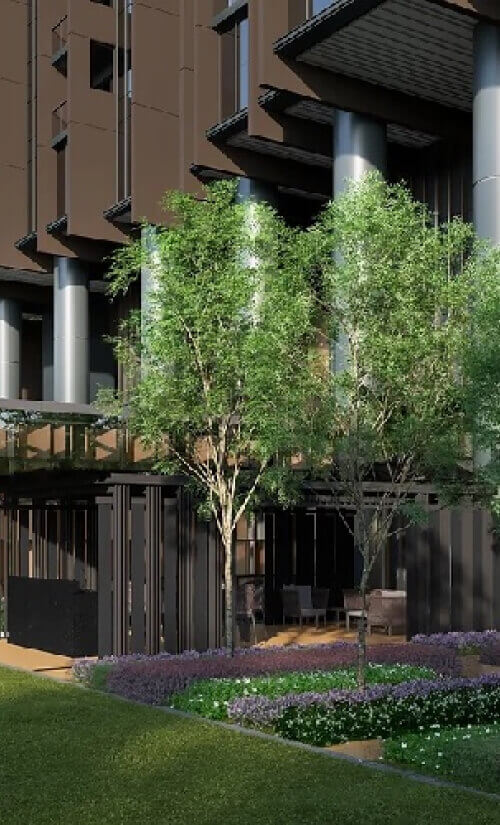

The Consumer Price Index (CPI) is the standard measurement for consumer inflation in Singapore. A fixed pool of about 6,800 brands or varieties of goods and services from 4,200 commonly purchased by Singaporean households forms our CPI-basket - as you can see the breakdown from below. The basket of items are tracked monthly to measure the changes in inflation rates.

(Source: Singapore Department of Statistics)

An interesting fact is, real estate is represented in the basket as the cost of rental, it does not take into consideration the appreciation of property prices. So you have to be mindful that when you see the monthly inflation rates, it has no relation to the price you are paying for your next home.

There are largely two kinds of inflation, headline inflation and core inflation, the former takes into consideration everything in the CPI-basket while the latter disregards accommodation and private road transport. For the purpose of this article when we mention inflation we are referring to headline inflation, let's take everything into consideration just to see how expensive life has actually become.

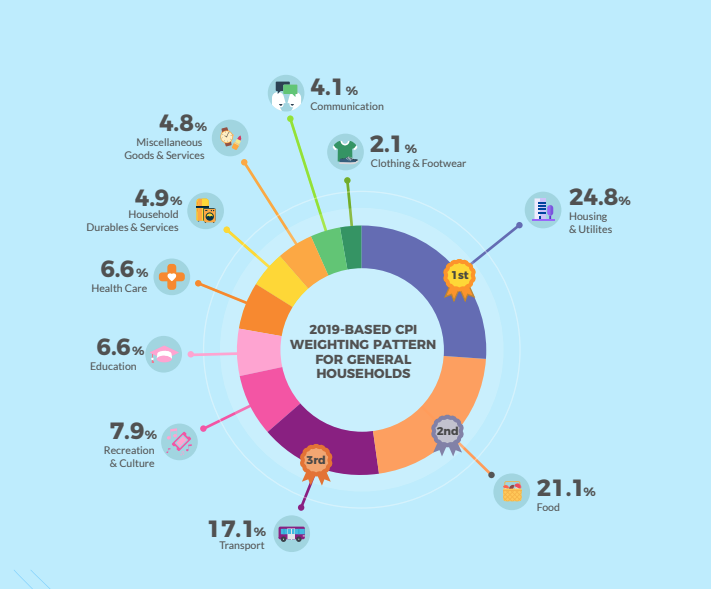

As I mentioned earlier, if the inflation rate is at a slow and stable pace, it is actually a good thing, signifying the healthy growth of our economy. Over the span of 20 years, Singapore's CPI has gone up by about 52.1% which means things in general are 52.1% more expensive just over a period of two decades.

That's why people are always looking to hedge their money against inflation. Because let's be real, letting your money sit in your bank account and collecting miserly interest or waiting for your wage to rise is probably not such a good idea.

Put it this way, with $10 now you can buy two plates of chicken rice at the hawker centre, how many plates of chicken rice do you think you can buy with $10 in 10 years' time? So what are some ways we can hedge against inflation?

Not in the bank please

One of the worst things you could do is to leave the money idling in the bank and expecting the annual interest rates to pay for anything, it can barely beat inflation let alone pay for any sort of lifestyle you are dreaming of.

Growing your money over time

There are several means and methods of growing your money over time exponentially and ensuring that your dollar value does not erode with inflation. Truth be told, wage is actually inherently linked to inflation, as the rise in wage is supposedly in accordance with inflation rates. But honestly, how many of us can say that our raises are in line with expanding inflation?

Finding the right investment vehicle

Unless you are racking in six-figure salaries a year, you should put more thought into investing and safeguarding your future while you are still able to. Even those who are top earners have investment plans of their own because of the importance of growing your money. What are some of such instruments we can explore to hedge against inflation?

What are some forms of hedges against inflation that are popular with everyone? Let's compare them with real estate to see how they fare:

| Hedge | Asset | 20-Year Growth annualised | Pros | Cons | Risk Level |

| Real Estate (Singapore non-landed private property market) | Tangible | 4.76% |

|

| Low |

Stocks (S&P 500) | Intangible | 7.7% compounded |

|

| High |

| Gold | Tangible | 8.26% |

|

| Medium |

Buying properties remains a very lucrative way for people to hedge against inflation, especially when you buy into a strong and resilient market like in our sunny island Singapore.

If we were to take a look at property prices versus inflation over the last 20 years, we can evidently see that property prices in Singapore outpace inflation by about three times! This significant difference is evident that real estate is a great hedge against inflation.

Singapore property is often considered a good hedge against inflation for several reasons:

Strong Demand and Limited Supply: Singapore has a small land area and a high population density, which leads to limited supply of property. Despite inflationary pressures, the demand for property, especially residential and commercial real estate, tends to remain strong, driving property prices upward.

Economic Stability: Singapore is known for its stable and well-managed economy, with low inflation rates and a strong currency. This stability makes property investments relatively safer compared to other assets that may be more volatile during inflationary periods.

Rental Yields: In an inflationary environment, rents generally increase as the cost of living rises. Since property owners can adjust rents to keep pace with inflation, they benefit from higher rental income, which helps protect their investments against inflation.

Government Policies and Regulations: Singapore's government has a strong track record of implementing policies that support the real estate market, such as maintaining a robust legal framework, controlling speculative investments, and ensuring that infrastructure development meets demand. These measures help stabilise property values even during inflationary periods.

Asset Appreciation: Historically, property in Singapore has seen consistent long-term capital appreciation. As inflation erodes the value of money, the value of real estate often appreciates, providing an inflation-beating return for property investors.

Diversification: Real estate offers a tangible asset that can be used to diversify an investment portfolio. Unlike stocks or bonds, real estate investments are less susceptible to the volatility of the stock market, and they tend to retain or increase in value during inflationary periods.

These factors make Singapore property a strong, long-term hedge against inflation, helping investors maintain and grow their wealth even in uncertain economic times.

I suppose in Singapore's context, the main reason why real estate would be a better choice is due to the government's intervention making sure the prices of our real estate are resilient. We wouldn't see a point where property prices are going to suffer an unfortunate crash and burn like the examples of Lehman Brothers or digital token LUNA. Which also leads me to the point where volatility is definitely an issue for stocks and gold as opposed to real estate. And imagine having the ability to receive monthly passive income from rentals, I think that's an absolute plus point when investing in real estate. There is very good potential to get great returns within the short-term through property. Maybe a good place you might want to start might be a mass-market condo, which you could see in this article where I looked at the condos that TOP last and see how well they fared.

There are many ways to hedge against inflation, just got to understand what you are getting into and know the risks involved. Always speak to a professional when you are in doubt and I am sure we all can beat inflation together!

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.